SUBMIT ORDER FORM

- All figures will be calculated based on your gross/net salary.

- Our team will make modifications to your replica SA302 to meet your specific needs.

- Your SA302 will appear authentic and original.

- High quality 100 gsm paper is used for printing the hard copy version of your novelty document/bill.

- The printed copy will reach you within three business days.

- The soft copy of your replacement document will be emailed to you within 2 days.

- Words like “sample” and “specimen” are never mentioned on our documents.

- In order to give a more authentic impression, your SA302 will feature a front as well as a back page.

- If your preferred SA302 template is unavailable, you must always feel free to contact our helpful team members to resolve the issue and provide you with your required design.

- Most importantly, these replica SA302 documents must only be used for novelty purposes.

SA302

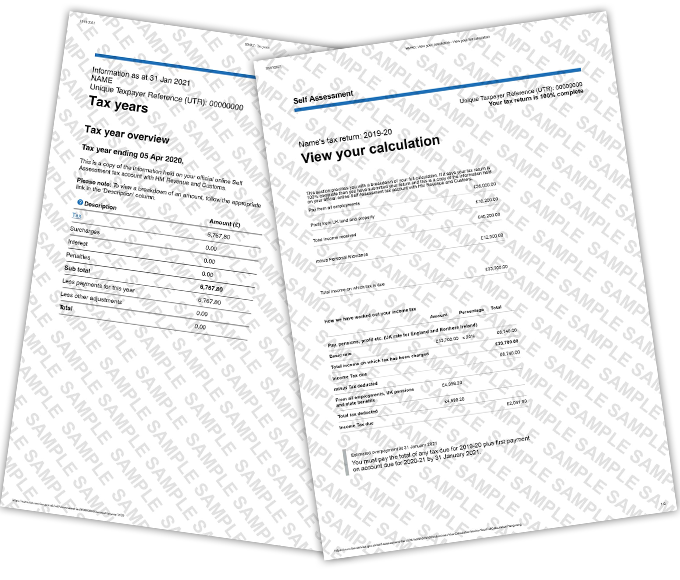

A self-assessment tax bill containing private information about a person’s earnings which are reported to the HM Revenue and Customs (HMRC) is termed as the SA302 document. In addition to providing a brief overview of a person’s income, this document also contains information related to private property, taxes paid to the HMRC, credits, due taxes and penalties etc. along with Tax Reference Number (TRN) information. The SA302 is issued only to those individuals who have paid their due taxes within given deadline(s). It runs out on 31st of October at midnight for those sending self-assessment tax return via post and on 31st of January at midnight for those submitting tax return through online processing.

Tax Overview

A summary or snapshot of your income that HMRC knows about and your taxes paid at a particular time is called Tax Overview. The summary includes information about personal taxes that either:

- HMRC has record for

- You report on your tax return

At the end of the tax year, HMRC checks the amount of PAYE tax that you have paid against what you needed to pay.

OnlineNoveltyDocs provides Self-Assessment tax return documents that look just like original SA302 and Tax Overview documents. It includes information such as; HM Revenue, Tax Number Reference (Ref), Organization Unit Identifier (OUID), Custom logo, Year, Name of the individual, Income received before tax was taken off, Property details, Due tax on the total income, self-employed proof of income (if self-employed), Pension details, Income Tax charged, Dividend and Tax credits (if any). Every bit of information necessary for an original document is included in the novelty document. However, the calculation is based on slightly different figures which are reported to the HMRC.

For placing an order for a novelty SA302 document and Tax Overview document, the individual is first required to select their desired SA302 template. If the client’s required SA302 sample is not available, then our professional staff can he contacted and they will reach out to you with your specific design along with an SA302 example for better illustration. To complete the required order, the SA302 form template must be filled out carefully. All details must be provided if asked for. Upon completion, the order has to be submitted.

We provide novelty SA302 in both printed and digital versions. If you want us to print SA302 novelty document according to your requirements, it is printed on a 100 gsm paper. The printed SA302 copy will reach you on your given home address in three working days. However, the soft copy of your document will be emailed to you within 2 days. The words “specimen” or “sample” will not be mentioned on your SA302 copy, either hard copy or digital version. Both copies will look just like real documents. You can even have access to various samples of SA302 online on our website. Our samples’ page features numerous SA302 examples including SA302 Cover Letter samples.

We provide novelty SA302 as a replica document intended only for novelty purposes. Their sole purpose is restricted to entertainment only and must not be used for illegal official reasons under any circumstance. It can be used for pulling off pranks on your friends or family. Because it looks real and original, nobody can point out if you are intending to joke around with it. On a lighter note, you can also use it to brag in front of your friends especially if you have not seen them for a long time. Besides looking like a real self-assessment tax return document, replica SA302 includes personal information and details related to taxes paid to the HMRC based on your income, property, earnings and pension etc. You can easily show it as your self-employed proof of income. This will make everyone believe that you really made it big. You can show off in front of your close ones and they won’t have the slightest clue that it is only a fake document intended to be used only for novelty reasons.

Although all sorts of novelty documents including replica SA302 are used for entertainment purposes, they can also be used in certain situations which require authentic-looking replicas. For instance, their requirement in theater performances, television series or television productions and films. Small details which appear original never fail to grasp the attention of the audience. This puts a very positive impact on the overall performance during such shows. However, if a theatrical performance or an entertainment show makes use of a replica SA302 that looks fake just by looking at it, it will without a doubt fail to inspire the audiences and will also lessen the overall rating of the performance.

Apart from TV shows, fake SA302 can be used in any other situation where a replica or replacement SA302 might be needed. Fake SA302 can be used as realistic fake props during presentations or speeches. A good thing about such novelty documents is that, if someone does not wish to reveal their private income and tax details during such situations, then they can easily make use of replicas for conveying their meaning and at the same time, not showing their personal information.

So whether these replica SA302 documents have to be used to entertainment purposes or for inspiring people during motivational sessions, people who use novelty SA302 created and provided by OnlineNoveltyDocs never have to worry about how authentic or real the document/bill looks like. Our skilled team strives to meet our clients’ requirements and demands. Features offered to our clients are as follows;

SUBMIT ORDER FORM